net investment income tax 2021 form

You are charged 38 of the lesser of net investment. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

You can compute your MAGI by.

. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Updated for the 2021 tax year our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage. A child whose tax is figured on Form 8615 may be subject to the Net Investment Income Tax NIIT.

If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable. For each child under age 19 or student under age 24 who received more than 2200 of investment income in 2021 complete Form 540 and form FTB 3800 Tax Computation for. This tax is an additional tax at the rate of 38 on investment income above certain levels.

2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service. Net Investment Income Tax. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the.

B the excess if any of. Product Number Title Revision Date Posted Date. The IRS gives you a pass.

April 28 2021 The 38 Net Investment Income Tax. Tailored for speed accuracy convenience. Download or print the 2021 Federal Form 8960 Net Investment Income Tax - Individual Estates and Trusts for FREE from the Federal Internal Revenue Service.

There is a TT oversight regarding form 8960. If a second couple also had 300000 of MAGI but 80000 was Net Investment Income their tax would be 1900 50000 X 38. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

The statutory authority for the tax is. Your modified adjusted gross income MAGI determines if you owe the net investment income tax. The Net Investment Income Tax in Practice.

A the undistributed net investment income or. If an adjustment is needed to the beneficiarys net investment income for section 1411 net investment income or deductions see below a manual adjustment will need to be made on. TT does not reduce your investment income by state and local taxes when calculating the investment.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. The adjusted gross income. NIIT is a 38 tax on the lesser of net investment income or the.

In 2013 a new income tax was added the Net Investment Income Tax. Page 1 of 20 740 - 4-Oct-2021. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

Net Investment Income Tax Individuals Estates and Trusts 2021 12082021. June 5 2021 340 PM.

Understanding The New Kiddie Tax Journal Of Accountancy

2021 Schedule Eic Form And Instructions Form 1040

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Solved You Are Working As An Accountant At A Mid Size Cpa Firm One Of Your Clients Is Bob Jones Bob S Personal Information Is As Follows October Course Hero

Irs Issues Draft Instructions For Net Investment Income Tax Form Wealth Management

What Is Form 8960 Net Investment Income Tax Turbotax Tax Tips Videos

/4592-f64c21a16a3847538c094ee48dee34fe.jpg)

Form 4952 Investment Interest Expense Deduction Definition

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

What Is The 3 8 Net Investment Income Tax Niit Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

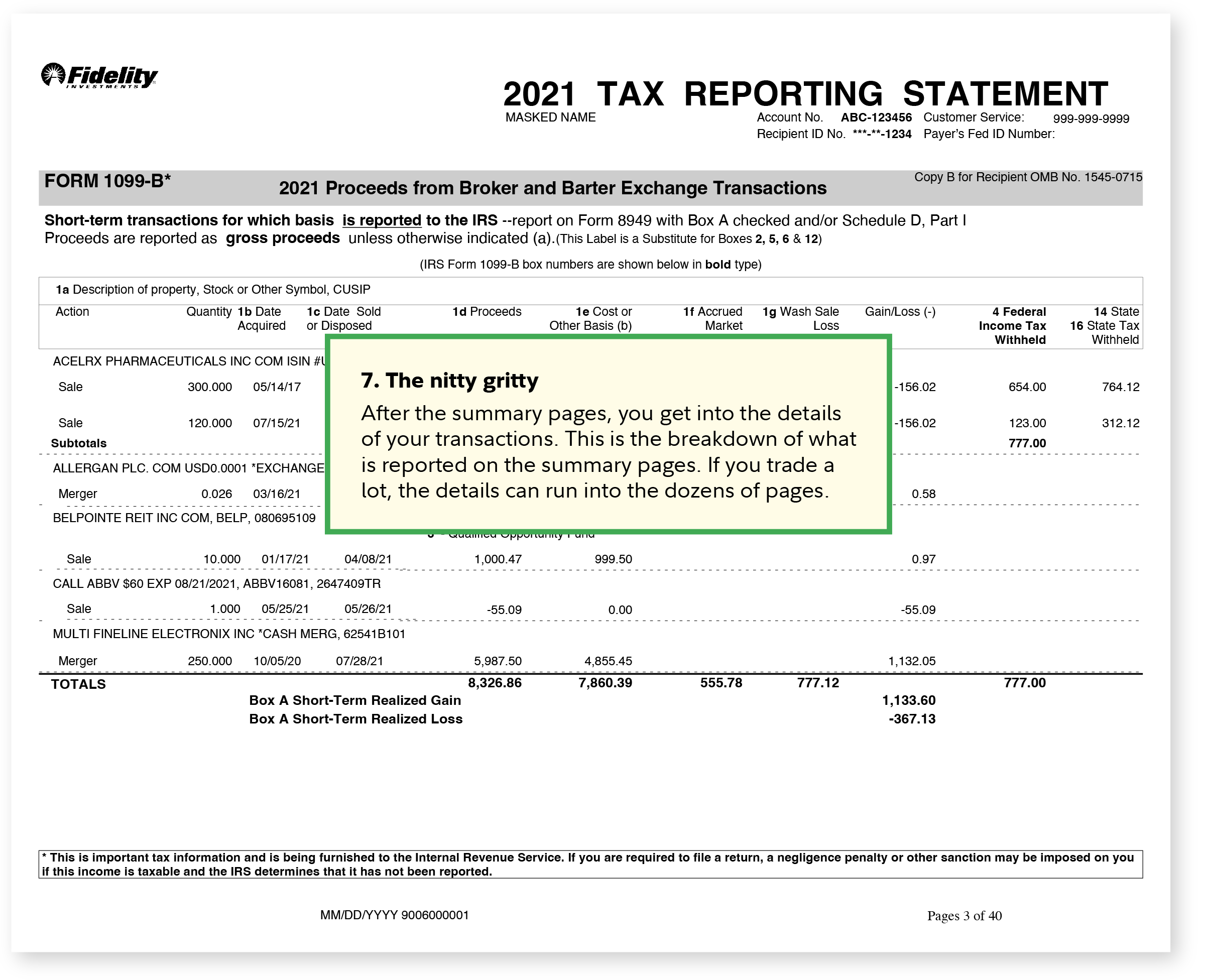

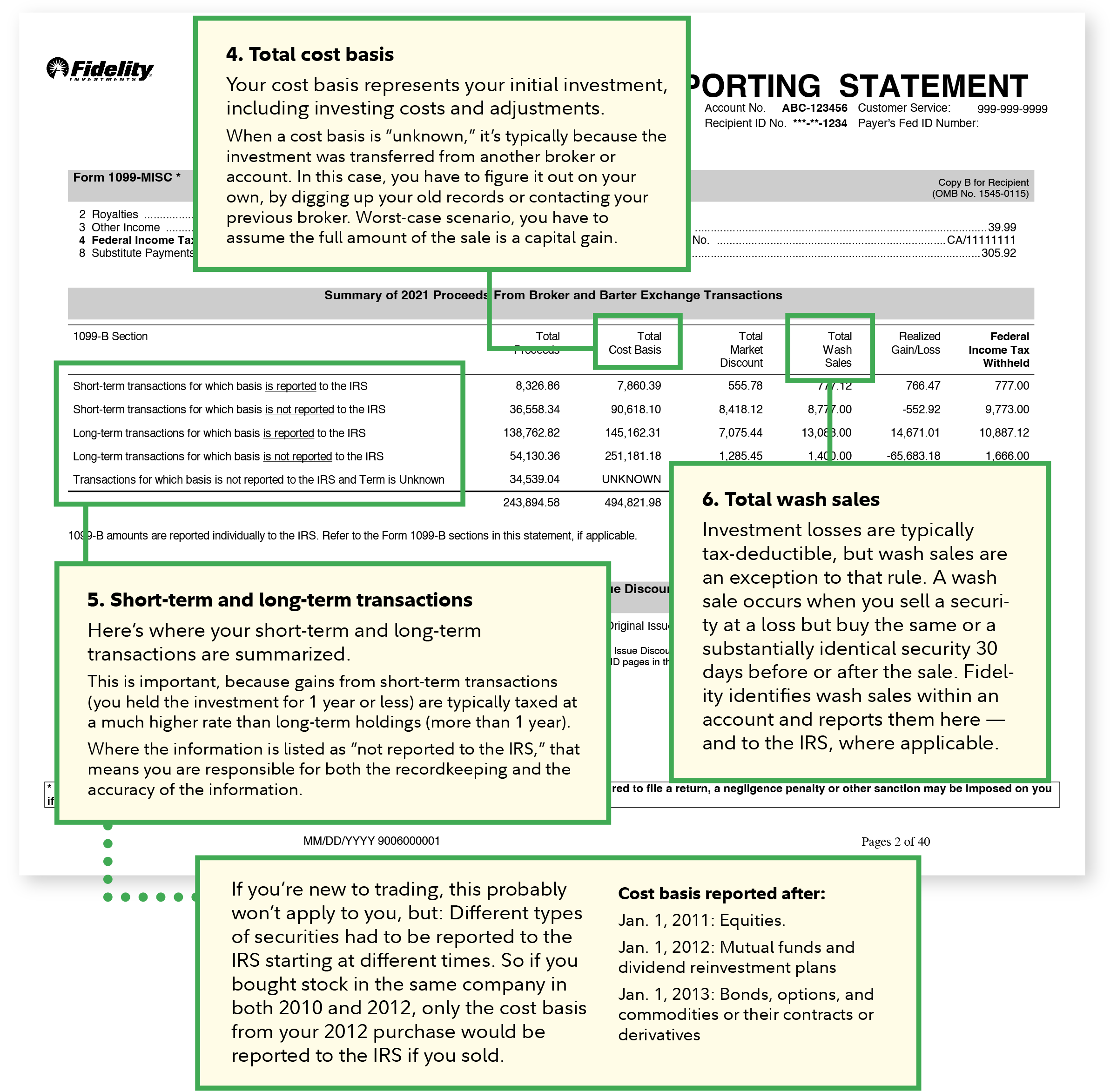

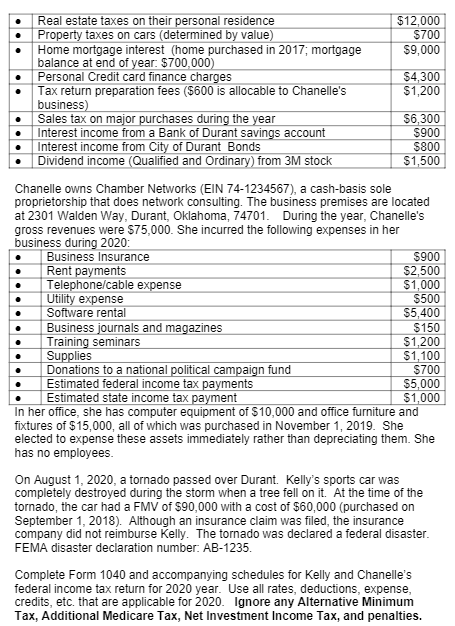

Income Tax Return Project 2 Spring Semester 2021 The Chegg Com

2020 Tax Year Forms And Schedules File Your Tax Return

/4592-f64c21a16a3847538c094ee48dee34fe.jpg)

Form 4952 Investment Interest Expense Deduction Definition

Investment Gains Float Weight Of 5 6b Underwriting Loss For U S P C Insurers In Nine Months 2021